is an inheritance taxable in michigan

Social Security payments are not taxed in Michigan. Michiganders currently pay a gas tax of 2630 cents per gallon.

Lexisnexis Practice Guide Michigan Probate And Estate Administration Lexisnexis Store

Why You Need an Estate Plan Even When You Dont Have Financial Assets.

. Plan for your future today. Capital gains in Michigan are taxed as regular income at the state rate of 425 though certain local jurisdictions may charge more. Michigan does not have an estate tax or an inheritance tax.

The childs generation is skipped to avoid an inheritance being subject to estate taxes twiceonce when it moves from the grandparents to their children and then from those children to their children. Is Social Security taxable in Michigan. Learn the specific estate planning documents you need to protect yourself and your loved ones.

If filing a part-year return you. Uncle Sam can tax up to 85 of your monthly retirement benefits. Michigan does not have an estate or inheritance tax.

The computed credit is reduced by 10 percent forvery1000 e or part of 1000 that total household resourcesxceed e 51600. A The taxable value of the family home subject to adjustment as authorized by subdivision b of Section 2 determined as of the date immediately prior to the date of the purchase by or transfer to the transferee. May 02 2022 3 min read.

Inheritance Tax You Only Have 6 Months to Pay. Social Security is taxable. States currently levy three types of marijuana taxes.

Inheritance and Estate Taxes. Mayotlaim n c a property tax credit if your taxable value exceeds135000 excluding vacant farmland classified as agricultural. Executor of a Will Duties and Responsibilities.

The computed credit is reduced by 10 percent forvery1000 e or part of 1000 that total household resourcesxceed e 51000. Mayotlaim n c a property tax credit if your taxable value exceeds136600 excluding vacant farmland classified as agricultural. The tax for diesel fuel is the same.

In Michigan the median property tax rate is. Could you have inherited more than you realize. Are Inheritance Tax Rules Different If Youre Married.

Can a Property be Sold before Probate is Granted. Estate Funds Distributed to Charities a Probate Case Study. How to Recover Unclaimed Inheritance Money There are millions of dollars of forgotten funds waiting to be claimed.

If filing a part-year return you. The Internal Revenue Code IRC has therefore applied an additional tax to these inheritances since 1976 which was repealed in 1986 and only applies. Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income AGI when filing your state taxes in Michigan.

As a percentage of price either the retail or wholesale price based on weight ie per ounce and based on the drugs potency ie THC level. The new taxable value of the family home of the transferee shall be the sum of both of the following. How to Stop a Solicitor or Bank being the Executor.

Marijuana sales are legal and taxed in nine states.

Michigan Inheritance Laws What You Should Know

Michigan Inheritance Tax Explained Rochester Law Center

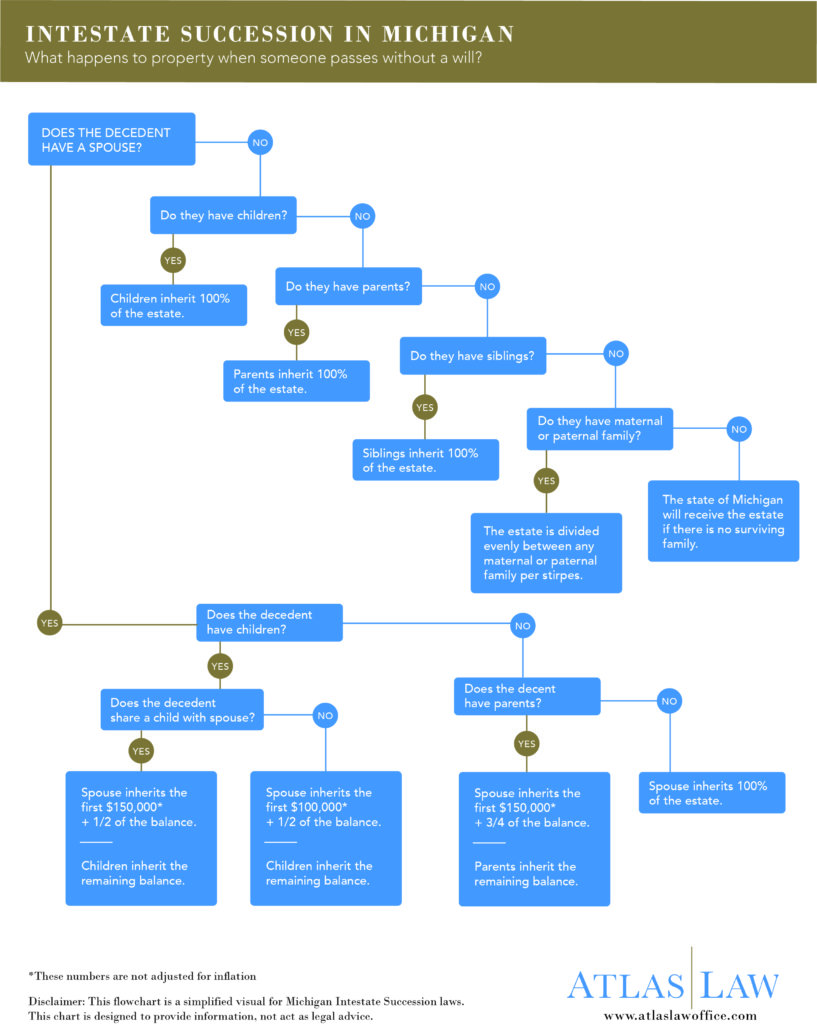

Michigan Rules Of Intestate Succession Atlas Law

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Property Tax Uncapping Update Thk Law Llp

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Lawmakers Urged To Get Rid Of Death Tax Moody On The Market

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Tax Explained Rochester Law Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

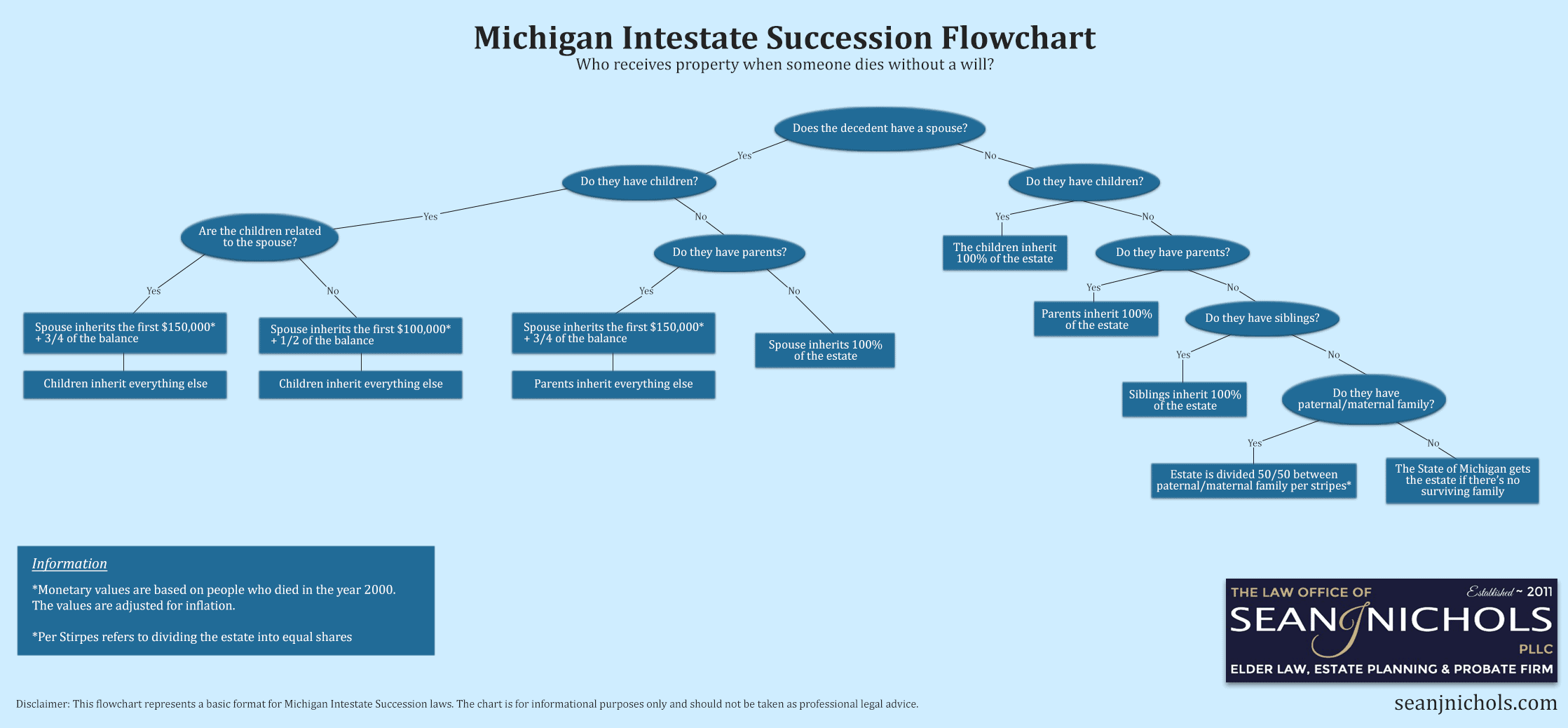

Michigan Probate Laws What You Need To Know

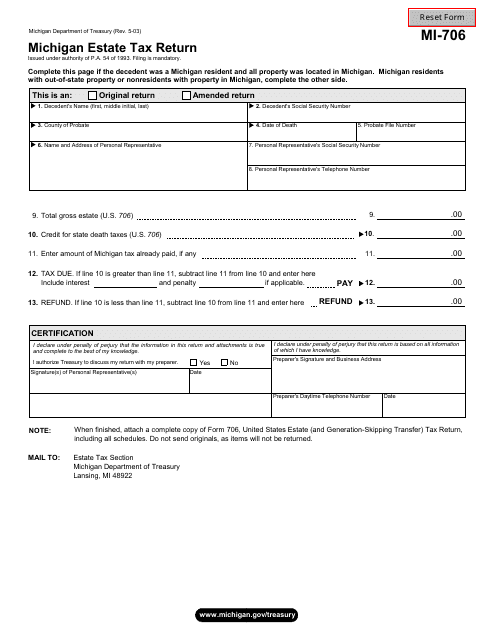

Form Mi 706 Download Fillable Pdf Or Fill Online Michigan Estate Tax Return Michigan Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Laws What You Should Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning